Contents

- RSI is computed based on the speed and direction of a stock’s price movement.

- Relative Strength Index (RSI): How It Signals Buy/Sell Decision in Stock Trading

- What is RSI (Relative Strength Index)?

- The formula for calculating RSI

- Relative Strength Index (RSI) – Why RSI Divergence, Overbought, & Oversold Conditions Fail Terribly?

To understand the concept of the RSI indicator in a better manner, let us consider the following example. 3) When a centre line cross happens, it can be a good time to think about trade entry on a fresh pullback in price also. Bullish Failure Swing – When RSI moves below example of research gap statement 30, then bounces back above 30 and then pulls back but holds above 30 and then breaks its prior high, it signals buy. While 70 and 30 are the two absolute confirmation levels, the movement of RSI towards these levels can also be considered as an entry or exit point.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. The above parameters are the general interpretations for securities at large. Traders have to consider the individual strength of the underlying security for correct analysis as well. A stock or a security is generally considered to have an uptrend if the price is above 50 and a downtrend if the price is below 50.

RSI is computed based on the speed and direction of a stock’s price movement.

Investors are always trying to gain an edge over the market, and a popular way is to apply economic metrics to the stocks they like – before pulling the trigger and buying them. And one of the most effective market measurement metrics – is the Relative Strength Indicator. Investments in securities market are subject to market risk, read all the related documents carefully before investing.

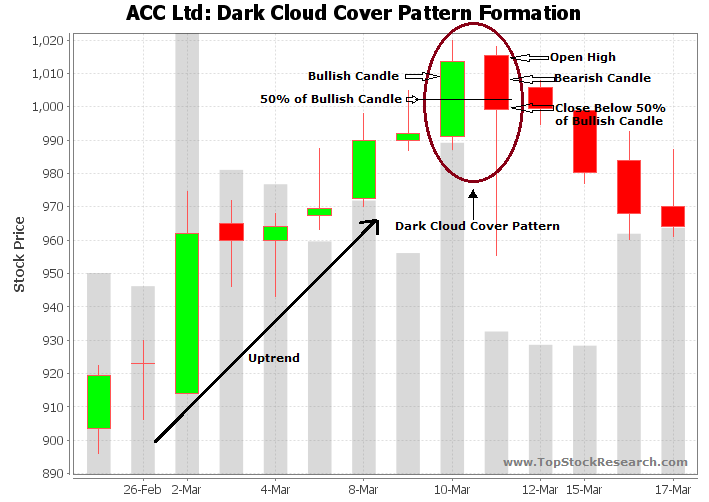

If it rises above 50, it means momentum is increasing, which should mean that price should also increase and vice versa. So, one needs to buy above the pink band, that is above 60/70, while they should sell below the band, that is below 40/30. The chart you see is of the daily timeframe and uses the technique described above. You will notice that the first trade made a very handsome profit and was able to catch the trend. The second and third did not follow through upwards and would have resulted in a loss. The RSI is used as over bought and over sold indicators, divergences and even centerline crossover.

- If you are looking at a possible uptrend, then make sure the RSI is above 50.

- The MACD is calculated by subtracting the 26-periodexponential moving average from the 12-period EMA.

- The RSI provides technical traders with signals about bullish and bearish price momentum, and it is often plotted beneath the graph of an asset’s price.

- This oscillator tool is displayed as a line graph that moves between two extremes .

- These values are then applied to the above formula to derive a number that ranges from 0 to 100.

- Here the RSI is around the oversold levels of 30 and shows divergence with the price action in theBank Nifty.

Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Remember, a smoothening effect will cause the RSI value to differ slightly. RSI calculated on a period of 250 will have more smoothening effect than RSI calculated on 30 periods. Wilder used the 14 day RSI, which is still the most commonly used RSI. However, an analyst is free to decide the number of days for computing the same.

Relative Strength Index (RSI): How It Signals Buy/Sell Decision in Stock Trading

The Indian stock market has come a long way from an open outcry system where investors had to visit the stock exchange with physical share certificates to make a trade. Today, you just have to log in to your demat account to see every financial information available about a particular stock. The charts, graphs, financials, etc., are were lacking when there were no technologically backed trading platforms. RSI indicators are one of the easier technical analysis tools that can be used by traders for their daily trades and for taking suitable positions for the long term or short term. Relying solely on the RSI indicators for trading decisions may lead to erroneous interpretations that can wipe out the net gains of the portfolio. Relative strength index is a technical indicator that measures the strength of current price trends in comparison to previous price trends.

Relative Strength index is an Indicator that almost everyone uses. So most of us would have heard the terms ‘Overbought’ and ‘Oversold’. RSI indicates when the stock price moves into overbought and oversold zones. The Relative Strength Index is a widely used technical indicator that assists traders in identifying potential buy and sell entry points. It measures both the speed and the rate of change in market price fluctuations.

What is RSI (Relative Strength Index)?

The RSI, like most indicators is the calculation of averages, this is what the calculation looks like. The modus operandi observed is that once a client pays amount to them, huge profits are shown in his account online inducing more investment. However, they stop responding when client demands return of amount invested and profit earned. If you are long on a stock, then the oversold region is an indicator that you should be careful while buying the stock.

Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. The Relative Strength is a ratio used to compare a stock with another stock, index or benchmark, allowing investors to understand its performance. The Relative Strength Index is an indicator used to learn whether a stock is overbought or oversold. When it comes to overbought and oversold stocks, the big question is not ‘if’ but ‘when’. The timing of your entry and exit is what matters as it can allow you to either realize profits or losses. The Relative Strength Index answers the question of ideal entry and exit points for investors.

Traders in that situation might delay buying until they see other technical indicators confirm their buy signal. The RSI compares bullish and bearish price momentum and displays the results in an oscillator placed beneath a price chart. Like most technical indicators, its signals are most reliable when they conform to the long-term trend. As a momentum indicator, the relative strength index compares a security’s strength on days when prices go up to its strength on days when prices go down. Relating the result of this comparison to price action can give traders an idea of how a security may perform. The RSI, used in conjunction with other technical indicators, can help traders make better-informed trading decisions.

Likewise, an overbought reading during a downtrend is much lower than 70. Let’s start with the Relative Strength Index or RSI, the three words that make this indicator. It is a momentum indicator which is the key strength of the price.

The RSI helps to spot reversal patterns early making it the right tool for such traders. Similarly, in pullback trading, the RSI indicator can be used to make the right entry point in an established trend when the market has pulled back. An RSI divergence tool spots the loss of momentum in the current market trend https://1investing.in/ and signals possible reversal in trends. The RSI divergence is an earlier indication of a possible break of trend as it doesn’t correlate with the current price action. The RSI divergence indicator signal suggests traders when RSI and the price action of the stock are no longer showing the same momentum.

Previous issues covered momentum indicators such as rate of change and moving average convergence divergence . This edition introduces the relative strength index , one of the most popular technical indicators. RSI is displayed as an Oscillator and can be read in increments of 0.0 to 100.

The overbought level set at over 70 and oversold level set at below 30. But this indicator cannot be analysed in isolation and traders need to establish the overall trend direction before acting on RSI signals. The Relative Strength Index is a momentum oscillator that measures speed and change of price movements.

The RSI will increase as the number and size of positive closes increase, and it will fall as the number and size of losses increase. A stock is ‘Overbought’ if the indicator oscillates above a reading of 70 and ‘Oversold’ if it’s below 30. Based on these 5 RSI range concepts one can easily trade indices/stocks. This concept works on all kind of charts whether it’s of Index, Stocks, Commodities, Currencies etc. However, a trader must gain mastery of price action trading if he wants to grow in his trading career.

Through this, investors can interpret the strength in the trend for an asset. Ideally, buying opportunities can be explored when RSI is in the oversold zone and a reversal of the prior downtrend/down move is observed. Similarly, shorting opportunities can be explored, when RSI is in the overbought zone and a reversal of the prior uptrend/up move is observed. Using RSI along with other indicators like moving averages, MACD, pivot points, etc. can help you gain a more confident view. Among various tools of technical analysis, momentum oscillators study the velocity of change in the price of stocks. RSI Indicator is one such momentum oscillator and was first introduced in 1978 by J.

The formula for calculating RSI

In both cases one needed a weapon few traders are able to yield correctly – Patience. In this video Apurva has revealed his favorite trading strategy. He uses RSI divergences to identify important reversals on various timeframes.

For example, if a security is repeatedly reaching the overbought level of 70 you may want to adjust this level to 80. • The RSI is often used in conjunction with trend lines, as trend line support or resistance often coincides with support or resistance levels in the RSI reading. 5) When RSI trend is rising and price trend is falling and RSI is in oversold state then a reliable buy signal is generated. 4) When RSI trend is falling and price trend is rising and RSI is in overbought state then a reliable sell signal is generated. RSI tends to vary between 40 to 80 in bullish market and zones act as support and pullback into RSI (40-50 zone) is buy signal. The traditional interpretation of RSI indicates that when any security’s RSI is below 30, it is oversold.

Divergence occurs when a price line shows a new high or low that isn’t confirmed by RSI indicator. It is a critical indicator which shows a price reversal trend. RSI calculates the strength of a stock trend and predicts reversals.

For calculating the next average losses, multiply the previous average losses by 13 and add today’s loss if any and divide the result by 14. In our example, we will multiply the average absolute losses of 5 days and add today’s absolute loss and divide by 14. It indicates whether a stock is ‘Overbought’ or ‘Oversold’.

Since the indicator is normalised and bounces between 0 and 100 it can be used to initiate trades using the techniques mentioned above. The author has done a Bachelors in Banking and Insurance . Her goal is to help readers make better investment decisions. Hence, traders have modified the traditional RSI to use it in modern times. We have discussed the modified RSI in detail on The Right Choices with Oracles of Dalal Street.

This can be useful to spot trend strength and potential reversals. Bullish divergence signals for the potential uptrend when the prices fall to a new low but the RSI indicator fails to do so . This indicates the reversal of the downtrend with the bearish trend losing its grasp in the market. A bearish divergence is observed when the prices make a new high while the RSI oscillator refuses to reach a new high.